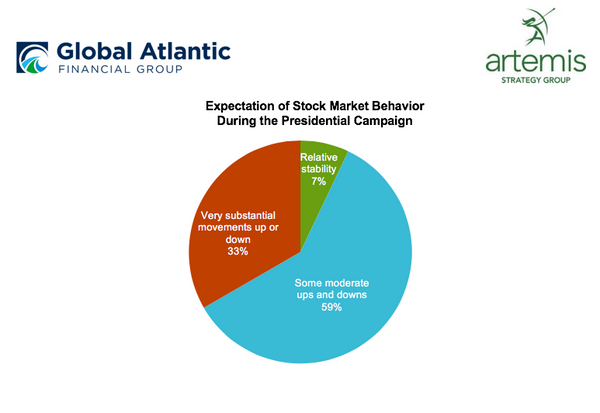

Global Atlantic Financial Group’s newly released “Vote for your Retirement” study reveals that one-third of investors expect “very substantial” stock market volatility during the 2020 presidential campaign (Figure 1). Another 59% expect to see “some moderate” ups and downs in the stock market.

The study examined more than 1,000 investors’ views on their retirement strategies in a tumultuous election year. Nearly half of investors (45%) believe that the political party that wins will have an impact on their retirement strategy, while almost one quarter (23%) said that the winning party would not (Figure 2).

Even amid the continued stock market rally in 2019, nearly half of respondents either already have (21%), or plan to (24%), shift to more conservative investments over the next 12 months (Figure 3). In addition, one in ten (10%) have purchased an annuity to provide protection over the past 12 months and an additional 12% plan to buy one over the next 12 months.

“The shift we are seeing to more conservative investments, including continued and increasing interest in annuities, reflects not only the concerns that investors have about what the election may mean for their equity investments, but also for their retirement plans,” said Paula Nelson, President, Retirement at Global Atlantic. “Many investors who are concerned about the election are looking to create a retirement income strategy that protects their income, regardless of who wins in 2020.”

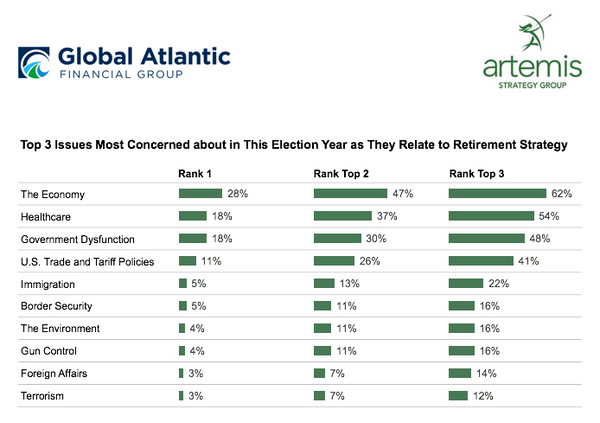

The top investor concerns related to retirement strategies include the economy, healthcare, and government dysfunction (Figure 4). Women are more likely to be concerned about healthcare, while men are more concerned about trade and tariff policies.

Detailed findings from the survey can be viewed on VoteRetirement.com, an educational and interactive webpage for consumers to learn more about how 2020’s Presidential election could affect their retirement savings plans.

Methodology

The Global Atlantic “Vote for your Retirement” study is a national online study. A total of 1,004 investors between the ages of 40 and 74 participated. Participants have $75,000 in investable assets and are involved in their households’ long term key financial decisions.

The survey was conducted by Artemis Strategy Group, a communications strategy research firm specializing in brand positioning and policy issues. The firm, headquartered in Washington D.C., provides communications research and consulting to a range of public and private sector clients.

About Global Atlantic

Global Atlantic Financial Group, through its subsidiaries, offers a variety of options to help Americans customize a strategy to fulfill their protection, accumulation, income, wealth transfer and end-of-life needs.

Global Atlantic was founded at Goldman Sachs in 2004 and separated as an independent company in 2013. Its success is driven by a unique heritage that combines deep product and distribution knowledge with insightful investment and risk management capabilities, alongside a strong financial foundation of over $85 billion in assets.